NVIDIA Corp (NVDA) shares reached a new record high on Monday, surging over 4% to top $514 each. This increase in stock price came after Nvidia’s presentation at the CES event and news about its business dealings with China.

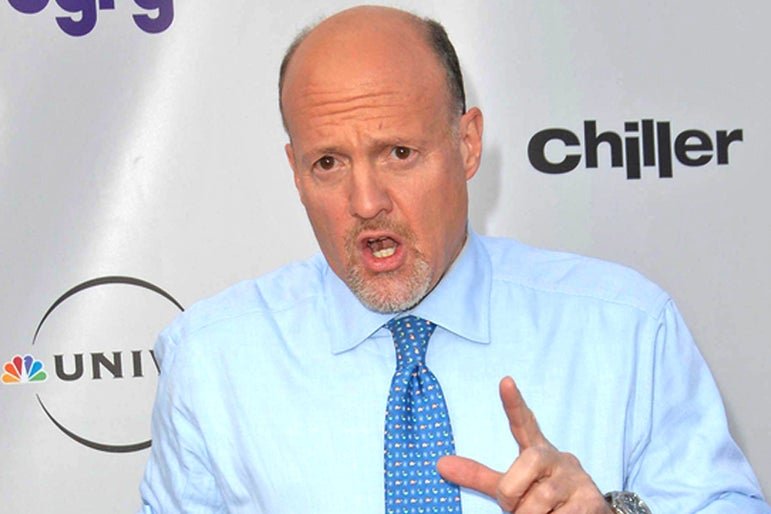

Since hitting a recent low on October 26, Nvidia’s stock has experienced a 27% increase, outperforming the S&P 500’s 14% growth during the same time frame. Despite the stock more than tripling in the last year, CNBC’s Jim Cramer believes that the company is still undervalued.

Currently, Nvidia trades at approximately 24 times forward earnings, compared to its five-year average of 39. However, Nvidia’s faith in the leading AI chipmaker remains unshaken, as it rose 239% in 2023.

Nvidia is reportedly starting mass production of AI chips for Chinese customers in line with the U.S. government’s revised export rules on AI technology. However, Chinese tech giants such as Alibaba Group Holding Ltd (BABA) and Tencent Holdings Ltd (TCEHY) plan to order fewer Nvidia chips in 2024, favoring Chinese firms and their custom processors instead. Despite this impact, Cramer downplayed it, suggesting that Nvidia’s data center chips remain superior.

On the same day, Nvidia also announced new GPUs for personal computers and professional workstations at the CES conference. These GPUs are designed to unlock the full potential of generative AI on PCs.

Cramer has consistently voiced his confidence in Nvidia, even in the face of competition and market rumors. When there were rumors about Microsoft Corp (MSFT) challenging Nvidia with its own AI chip, Cramer affirmed his positive stance on Nvidia. Even after Microsoft launched its in-house AI chips, Cramer maintained that Microsoft couldn’t compete with Nvidia. His unwavering faith in the chipmaker has remained strong despite market fluctuations and competitive threats.

It is clear that Nvidia’s stock is on an upward trajectory, with its recent record-breaking performance and promising business dealings with China. As the company continues to innovate and expand its presence in the AI chip market, investors and analysts like Jim Cramer see significant potential for further growth in the future.

Image Via Shutterstock