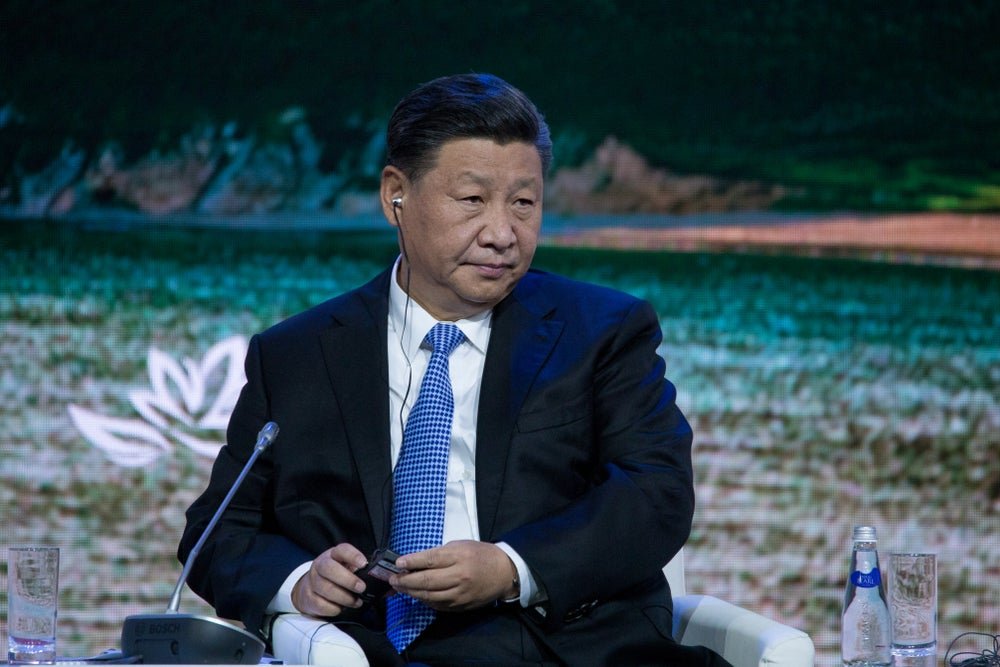

In a bid to stimulate growth amid a declining property sector, Chinese President Xi Jinping is shifting the country’s economic model, potentially sparking global trade unrest.

China’s leaders are investing heavily in manufacturing, particularly in the sectors of electric vehicles, batteries, and renewable energy. These areas are dubbed as the “new three” growth drivers, which support the global de-carbonization push and stimulate demand for commodities like copper and lithium, Bloomberg reported on Sunday.

While the strategy helps China stave off economic recessions, it also creates imbalances that could trigger renewed global trade conflicts. The U.S. and European Union have recently escalated warnings regarding China’s increasing capacity, prompting a series of trade investigations.

China’s economic model also affects developing countries like Vietnam and Indonesia, reducing their space in lower-end industries. Countries like Turkey and India that aim to attract more sophisticated industries have increased their protectionist measures against China.

“China wants to be the ‘make everything’ country,” said Damien Ma, a U.S. think tank Macropolo analyst, who had discussions with high-ranking policymakers in Beijing the previous year.

Last November, U.S. Treasury Secretary Janet Yellen warned of possible oversupply in industries where China heavily invests. In response, the Biden administration introduced selective subsidies in the Inflation Reduction Act aimed at pricing Chinese-made green technology out of the U.S. market.

The European Union Commission has also initiated an investigation into Chinese electric vehicles, a move seen as an effort to protect its industrial base from China’s overcapacities in protected industries.

Despite the brewing global tensions, China remains steadfast in its strategy, with President Xi Jinping referring to manufacturing as the “lifeline” and “foundation” of the country.

The transition won’t be smooth sailing. Goldman Sachs Group Inc. economists predict that the rapid growth of the “new three” industries won’t fully offset a real estate decline and diminishing gas-powered car production. This situation may result in a 0.5 percentage point cut to economic growth per year from 2023-2027 and affect urban employment.

Meanwhile, China’s housing construction is anticipated to decline for the third consecutive year despite governmental efforts to boost housing demand. This continuous contraction of the property market, making up around 20% of the GDP, down from 24% in 2018, has compelled China to pivot towards manufacturing as a key economic driver.

In conclusion, President Xi Jinping’s shift towards manufacturing as a means to stimulate growth in China’s economy has the potential to spark global trade unrest. While the strategy helps China overcome economic challenges, it also creates imbalances that could lead to renewed trade conflicts with the U.S. and European Union. The transition to a manufacturing-focused economy won’t be without challenges, as it may not fully offset the decline in the property sector and gas-powered car production. However, China remains committed to this strategy, viewing manufacturing as the foundation of the country’s economic growth.