PACCAR Inc (NASDAQ: PCAR) recently reported its fourth-quarter FY23 sales, surpassing analysts’ expectations and leading to an increase in the company’s stock price. The company achieved record annual revenues and net income, highlighting its strong performance in the market.

The fourth-quarter sales of PACCAR amounted to $8.59 billion, beating the consensus estimate of $8.35 billion. This positive result reflects the company’s ability to meet customer demand and capitalize on market opportunities. Additionally, PACCAR Financial Services reported increased revenues of $484.8 million compared to $394.8 million the previous year.

PACCAR also exceeded earnings per share (EPS) expectations, with earnings of $2.70 per share compared to the analyst consensus of $2.22. This demonstrates the company’s strong financial performance and its ability to generate profits for its shareholders.

Globally, PACCAR delivered a record-breaking 204,200 vehicles in the year. The company’s Class 8 truck industry retail sales in the U.S. and Canada reached 297,000 units in 2023, indicating its strong presence in the North American market.

In terms of investments, PACCAR allocated $698 million in capital projects and $411 million in research and development expenses in the year. These investments highlight the company’s commitment to innovation and technological advancements in the trucking industry.

As of December 31, 2023, PACCAR held $8.66 billion in cash and marketable securities, demonstrating its financial stability. The company’s operating cash flow for the year amounted to $4.19 billion, further emphasizing its strong financial position.

Looking ahead, PACCAR has provided an optimistic outlook for 2024. It expects Class 8 truck industry retail sales in the U.S. and Canada to be between 260,000 and 300,000 trucks. This forecast indicates the company’s confidence in its ability to maintain strong sales and market share in the coming year.

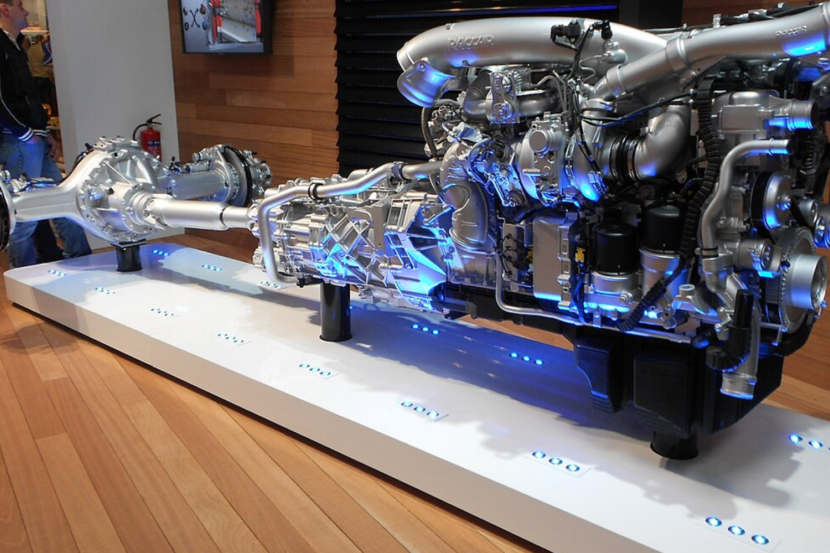

Harald Seidel, DAF president, highlighted the competitive advantages of DAF trucks in the European market. He emphasized the industry-leading fuel efficiency and driver comfort of the new generation of DAF trucks, which have contributed to the brand’s success.

PACCAR also anticipates European above 16-tonne truck industry registrations to reach between 260,000 and 300,000 trucks in 2024. This forecast suggests the company’s positive outlook for its European operations and its expectation of continued growth in the region.

In terms of shareholder returns, PACCAR’s Board of Directors recently declared a quarterly cash dividend of $0.27 per share, payable on March 6, 2024. This dividend payment reflects the company’s commitment to rewarding its shareholders and sharing its success.

Additionally, PACCAR paid an extra cash dividend of $3.20 per share on January 4, 2024. This payment further demonstrates the company’s dedication to providing value to its shareholders.

PACCAR’s stock price has responded positively to the company’s strong financial performance and future outlook. As of the last check, PCAR shares were up by 2.72% at $99.73.

Overall, PACCAR’s recent financial results and optimistic outlook for 2024 indicate a promising future for the company. With its strong market position, investment in innovation, and commitment to shareholder value, PACCAR is well-positioned to continue delivering strong performance in the trucking industry.