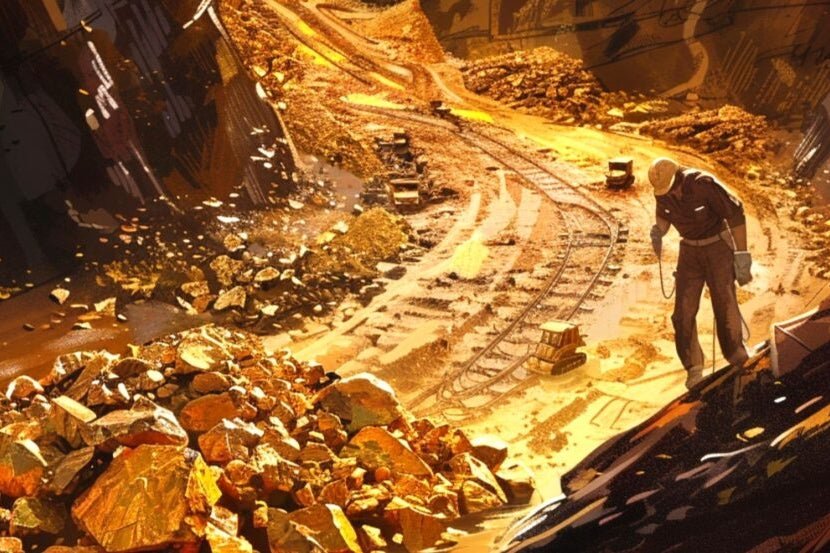

Newmont Corporation Initiates Sale of Akyem Gold Mine in Ghana

Newmont Corporation, a leading gold mining company headquartered in Denver, has reportedly started the process of selling its Akyem gold mine in Ghana. The move comes as a response to the rising gold prices and the company’s desire to generate cash through divestitures following its acquisition of Newcrest Mining Ltd. in November.

According to reports, Newmont has engaged Citigroup, Inc. for the sale of the Akyem mine and has begun reaching out to potential buyers. Among the companies expressing initial interest in the asset are Chinese producers such as Shandong Gold Mining Co. and Zijin Mining Group Co. Chifeng Jilong Gold Mining Co. and Australian miner Perseus Mining Ltd. have also shown interest in the asset.

In addition to the Akyem mine, Newmont aims to offload four gold mines in North America and one in Australia as part of its efforts to generate $2 billion in cash through divestitures. The company also plans to divest six non-core assets and two non-core projects in order to reduce its debt load by $1 billion in the short term.

By auctioning assets and streamlining its operations, Newmont hopes to achieve $100 million in free cash flow and improve its gold production to 6.7 million ounces by 2028. Despite the challenges faced by the company, including a 29% drop in its stock price over the past year, Newmont is optimistic about its future growth prospects.

Investors looking to gain exposure to Newmont’s stock can consider investing in ETFs such as iShares MSCI Global Gold Miners ETF (RING) and VanEck Gold Miners ETF (GDX). These ETFs provide a diversified portfolio of gold mining companies, including Newmont, and offer investors a way to participate in the potential upside of the gold market.

In conclusion, the sale of the Akyem gold mine in Ghana is just one of the strategic moves that Newmont Corporation is making to optimize its portfolio, reduce its debt load, and position itself for future growth. As the company continues to navigate the challenges of the mining industry, investors will be watching closely to see how these initiatives unfold and impact Newmont’s long-term performance.