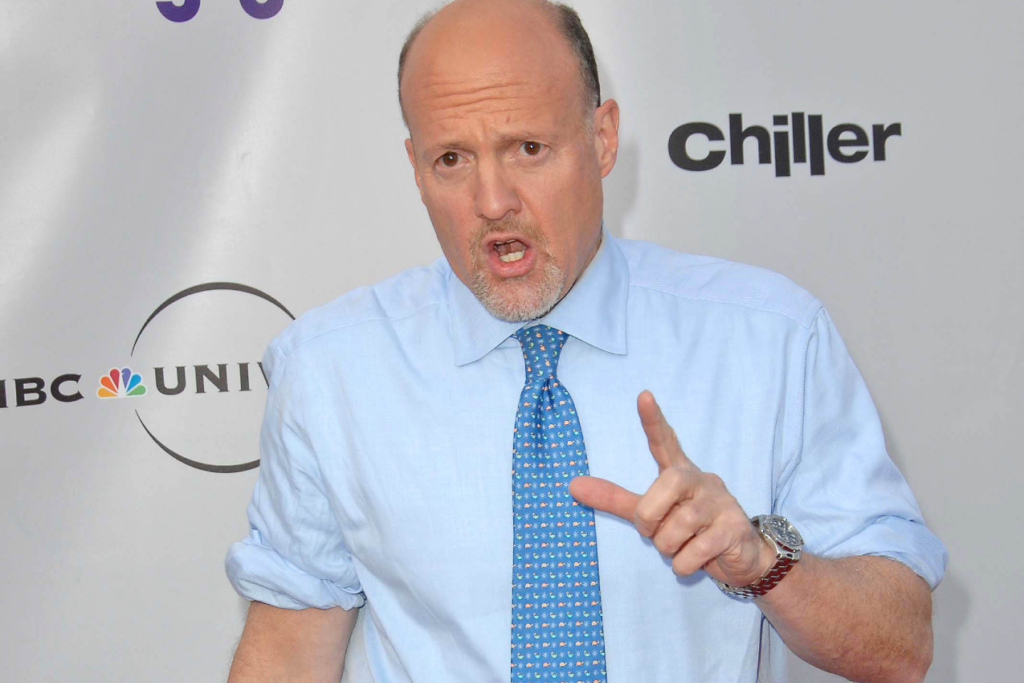

Jim Cramer’s Assessment of the Magnificent Seven Mega-Cap Companies

As the first earnings season of 2024 comes to a close, renowned financial expert Jim Cramer has provided his assessment of the latest financial reports from the Magnificent Seven mega-cap companies. Among these companies, NVIDIA Corp (NVDA) and Amazon.com Inc (AMZN) received special recognition for their impressive performance.

Cramer commended Nvidia for its record revenue, which saw a remarkable 265% increase driven by high demand for its AI products. He also praised Amazon for its growing advertising and web services sector, as reported by CNBC.

In a recent statement, Cramer emphasized the importance of a longer-term vision when evaluating company performance. He expressed disappointment in the prevailing focus on short-term outcomes during earnings season.

Nvidia was the first to receive praise from Cramer for its exceptional revenue growth, followed by Amazon, which he described as the “most definitive summa of all.” Cramer highlighted Amazon’s thriving advertising business and expanding web services sector.

Additionally, Cramer acknowledged Meta Platforms Inc. (META) for its robust advertising and WhatsApp business, and Microsoft Corporation (MSFT) for its strong cloud business. However, he noted mixed reviews for Microsoft’s AI product, Co-Pilot.

While Apple Inc. (AAPL) did not receive high honors according to Cramer, he believed that Wall Street’s assessment was overly critical. He had mixed views on Alphabet Inc. (GOOGL), praising its cloud business but critiquing its advertising sector. Tesla Inc. (TSLA) received a “gentleman’s C” from Cramer, who expressed uncertainty about the company’s outlook for the year.

Overall, Cramer stated that the seven mega-cap companies acquitted themselves well, with some receiving high praise for their performance during the earnings season.

Cramer’s assessment of the Magnificent Seven’s earnings highlights the significant influence of these tech giants on the market. However, he also suggests that investors should consider other stocks for potential high-yield investments.

In a previous prediction, Cramer suggested that Tesla might be the first of the Magnificent Seven stocks to fall, proposing Eli Lilly as a potential replacement. This prediction underscores the dynamic nature of the market and the importance of staying informed about changing trends.

In conclusion, Jim Cramer’s assessment of the Magnificent Seven mega-cap companies provides valuable insights for investors looking to navigate the ever-evolving landscape of the stock market. His analysis serves as a reminder of the importance of a long-term perspective and the need to consider a diverse range of investment opportunities.