The resumption of work by the United Auto Workers (UAW) is expected to have a significant impact on November payrolls, potentially countering the recent slowdown in U.S. job growth. According to Bloomberg, government data is likely to show a boost in payrolls by 180,000, up from a 150,000 increase in October.

However, despite this potential surge in job growth, there has been an average decrease of about 100,000 jobs over the past three months compared to earlier in the year. This indicates a deceleration in the overall job market.

The unemployment rate is predicted to remain at 3.9%, the highest it has been since the start of 2022. This suggests a more tepid labor market and restrained wage growth. It also eases concerns about inflation and reinforces the perception that the Federal Reserve will not raise interest rates.

The employment report also anticipates a 4% rise in average hourly earnings in November compared to the previous year. While this is still an increase, it represents the smallest yearly growth since mid-2021.

Despite the overall slowdown in job growth, consistent hiring and wage increases have continued to drive strong consumer spending in recent months.

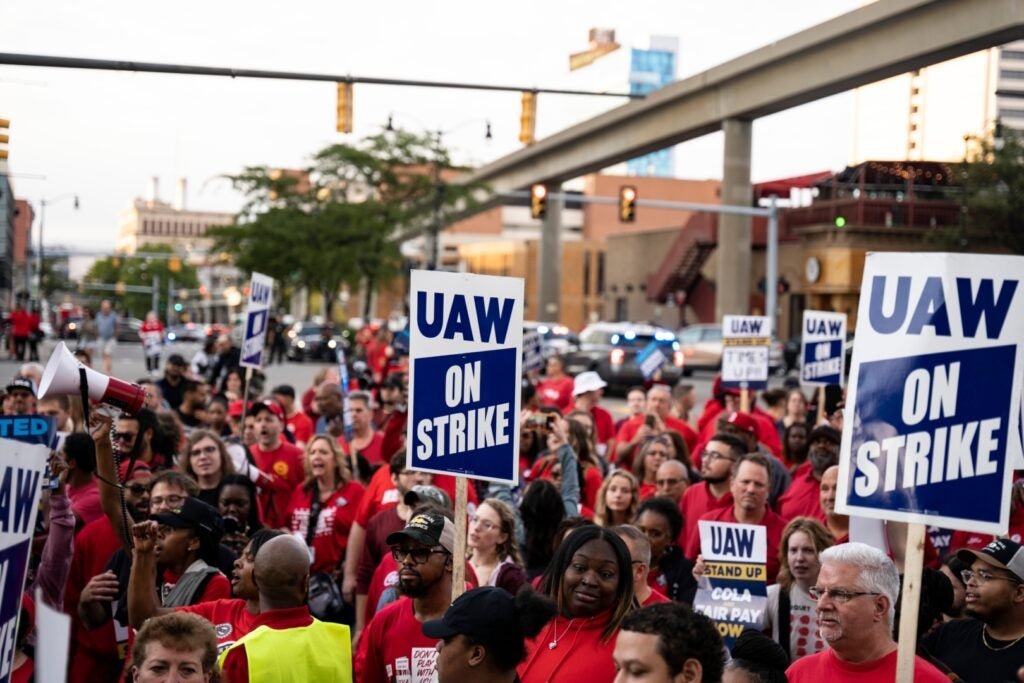

Previously, in October, major automakers General Motors, Ford, and Stellantis reached a tentative agreement with the UAW, ending a six-week strike that significantly disrupted US auto production. The deal included a 25% hourly pay increase and cost-of-living allowances over a four-and-a-half-year contract.

However, the UAW has also launched a campaign to unionize workers at 13 non-union automakers across the U.S. This initiative aims to include nearly 150,000 autoworkers from companies such as Tesla Inc and Toyota.

In conclusion, the resumption of work by the UAW is expected to have a positive impact on November payrolls, potentially offsetting the recent slowdown in U.S. job growth. However, the overall job market has experienced a deceleration, and the unemployment rate remains at a relatively high level. The employment report also suggests a slower growth rate in average hourly earnings. Nevertheless, consistent hiring and wage increases continue to drive consumer spending.