Asian Markets Show Mixed Performance; China Surges After Central Bank Move

On January 24th, U.S. stock markets closed with mixed results, with the S&P 500 reaching its fourth consecutive record-breaking close. Netflix (NFLX) was one of the top performers, surging 10.7% to reach a two-year high. The company’s strong subscriber growth and successful strategy against password-sharing contributed to investor confidence. Economic data also showed positive signs, with the S&P Global U.S. services PMI reaching a seven-month high and manufacturing PMI jumping in January.

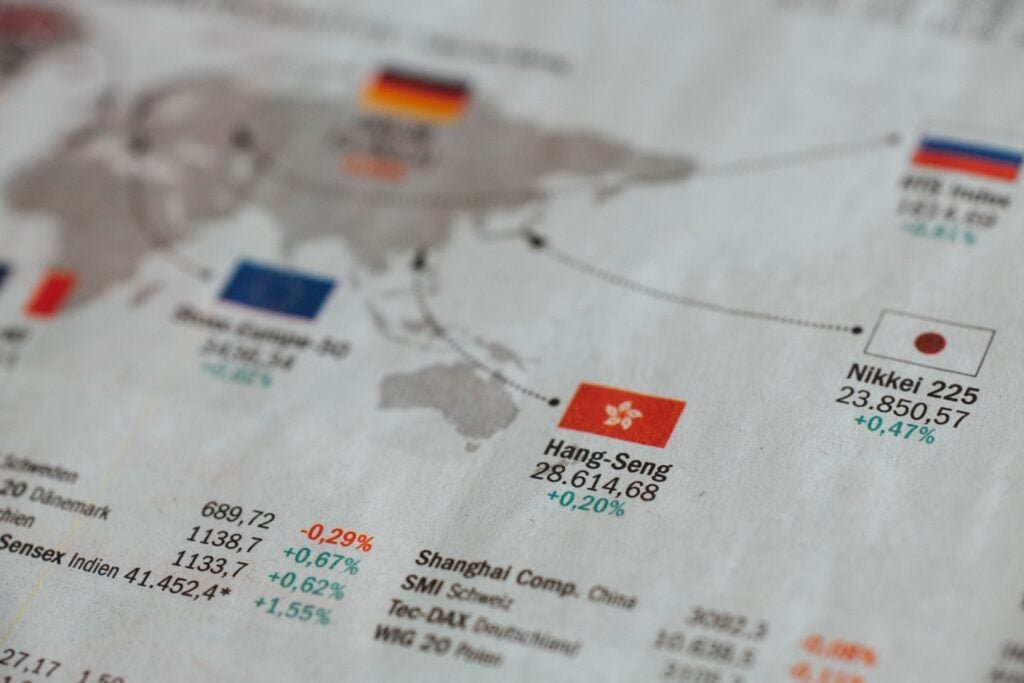

Turning to Asian markets, Japan’s Nikkei 225 index closed slightly higher by 0.02%, led by gains in the Banking, Mining, and Insurance sectors. In Australia, the S&P/ASX 200 was up 0.48%, driven by gains in the Metals & Mining, Resources, and Materials sectors. However, India’s Nifty 50 closed lower by 0.47%, and the Nifty 500 slid 0.30%.

China’s stock market experienced a significant surge, with the Shanghai Composite increasing by 3.03% and the Shenzhen CSI 300 gaining 2.01%. This rally came after the People’s Bank of China unexpectedly cut the reserve requirement ratio, releasing $140 billion in liquidity and easing lending rules for the property sector. The move was aimed at supporting economic growth.

Hong Kong’s Hang Seng Index also performed well, climbing 1.72% and closing the day at 16,172.75.

In the Eurozone, the STOXX 600 index was down 0.33%, while Germany’s DAX declined by 0.34% and France’s CAC slid by 0.40%. The UK’s FTSE 100 traded lower by 0.19%.

In the commodities market, Crude Oil WTI was trading higher by 1.28% at $76.05/bbl, while Brent was up 1.16% at $80.96/bbl. Natural Gas gained 2.61% to $2.231. Gold was trading up by 0.12% at $2,018.35, Silver rose by 0.51% to $23.008, and Copper climbed 0.11% to $3.8902.

Looking at U.S. futures, Dow futures were up 0.23%, S&P 500 futures increased 0.04%, while Nasdaq 100 Futures slid 0.05%.

In the forex market, the U.S. Dollar Index declined 0.03% to 103.20, USD/JPY gained 0.08% to 147.62, and AUD/USD fell 0.18% to 1.5176.

Overall, Asian markets showed mixed performance, with China’s stock indexes experiencing a significant rebound after the central bank’s unexpected move. The positive economic data and strong performance of Netflix contributed to the optimism in U.S. markets. Investors will continue to monitor global economic indicators and market developments to make informed investment decisions.