On Wednesday, March 6th, U.S. markets closed in green, boosted by economic data and remarks from Federal Reserve Chair Jerome Powell, which strengthened predictions of a U.S. interest rate cut this year. In economic data, U.S. private sector job growth increased to 140,000 in February from January’s 111,000, below the expected 150,000. Job openings slightly dropped to 8.863 million, and wholesale inventories decreased by 0.3% in January. Nine out of 11 key S&P 500 sectors closed higher, with utilities and information technology leading gains, while consumer discretionary saw the largest decline.

The Dow Jones Industrial Average gained 0.20% to close at 38,661.05. The S&P 500 increased 0.50%, ending the day at 5,104.76, and the Nasdaq Composite rose 0.58%, finishing the session at 16,031.54.

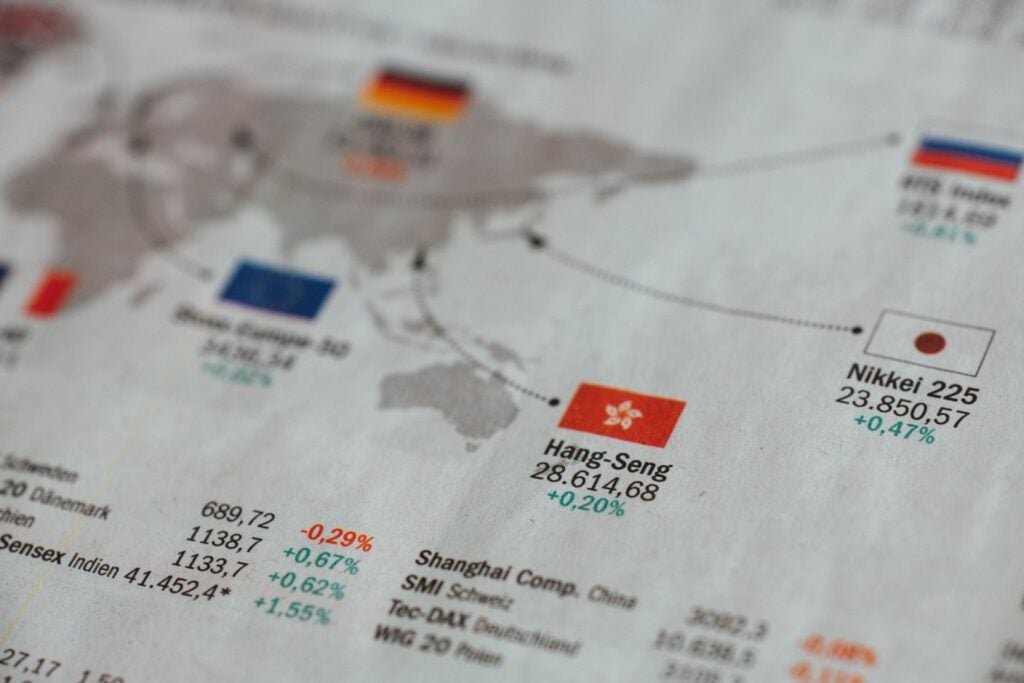

Asian markets today saw mixed performances. Japan’s Nikkei 225 index closed the session lower by 1.31% at 39,598.50, led by losses in the Precision Instruments, Communication, and Electrical/Machinery sectors. The Nikkei 225 index dipped Thursday, erasing early gains amid rising expectations of a Bank of Japan policy shift, overshadowing positive Wall Street cues. In Australia, the S&P/ASX 200 was up 0.39% and closed at 7,763.70, led by gains in the Gold, Industrials, and IT sectors. India’s Nifty 50 closed higher by 0.09% at 22,493.55, while the Nifty 500 was up 0.27% to 20,434.80. China’s Shanghai Composite declined 0.41% to 3,027.40, and the Shenzhen CSI 300 fell 0.60%, closing at 3,529.72. Hong Kong’s Hang Seng Index slid 1.34%, concluding the day at 16,218.00. China’s Jan-Feb trade surplus soared to $125.16 billion, surpassing the expected $110.30 billion, with exports jumping 7.1% year-on-year, well above the 1.9% forecast.

In the Eurozone at 06:30 AM ET, the European STOXX 600 index was up 0.36%. Germany’s DAX gained 0.06%, France’s CAC rose 0.13%, and the UK’s FTSE 100 traded lower by 0.02%.

In commodities at 06:30 AM ET, Crude Oil WTI was trading lower by 0.77% at $78.52/bbl, and Brent was down 0.76% at $82.33/bbl. Natural Gas was up 0.88% to $1.946. Gold was trading higher by 0.25% at $2,163.60, Silver fell 0.53% to $24.365, while Copper gained 1.31% to $3.9255. Gold prices reached a record high on Thursday, boosted by expectations of lower U.S. interest rates after comments from Federal Reserve Chair Jerome Powell.

US Futures at 06:30 AM ET showed Dow futures were up 0.09%, S&P 500 futures gained 0.23%, and Nasdaq 100 Futures rose 0.40%. In Forex at 06:30 AM ET, the U.S. Dollar Index declined 0.15% to 103.21, USD/JPY was down 0.99% to 147.88, and USD/AUD slid 0.60% to 1.5136.

Overall, the global markets are reacting to economic data and central bank statements, with investors closely watching for any developments that could impact market trends.