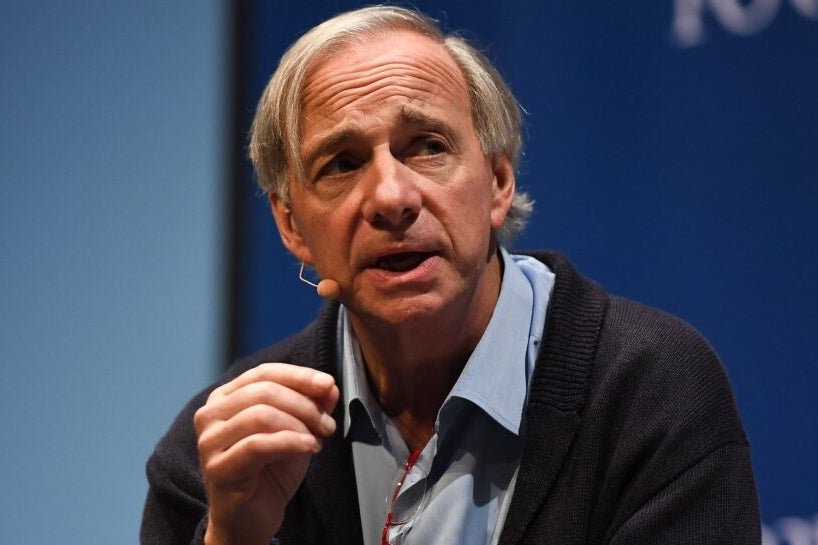

Ray Dalio, the former co-chief investment officer of Bridgewater Associates, the largest hedge fund, recently shared his analysis on the state of the U.S. stock market. Despite the recent significant rallies in the market, Dalio believes that the market is not in a bubble and does not exhibit typical bubble characteristics.

In a detailed analysis posted on LinkedIn, Dalio outlined the indicators he uses to spot market bubbles. These include high prices compared to traditional value measures, unsustainable conditions, an influx of new and inexperienced buyers, widespread bullish sentiment, a high percentage of purchases financed by debt, and a significant amount of forward and speculative purchases.

After applying these criteria to the U.S. stock market, Dalio concluded that the market is not in a bubble. He noted that the market is in the mid-range (52nd percentile) and does not align with previous bubbles. Dalio also discussed the “Magnificent 7” group of companies that have contributed significantly to U.S. stock market gains over the past year. While he acknowledged that valuations are slightly high, given current and projected earnings, he does not see excessive leverage or a surge of “new and naive buyers.”

However, Dalio also highlighted the potential for a significant correction, particularly if generative AI does not live up to the priced-in impact. Despite his analysis, ongoing debates about the state of the U.S. stock market continue. Capital Economics’ John Higgins predicted that the current stock market bubble would continue to inflate until the end of 2025, driven by the narrative around artificial intelligence.

The “Magnificent 7” group of companies mentioned by Dalio has seen its fortunes diverge this year, suggesting that the group’s dominance over the stock market is waning. On a related note, Ark Invest’s Chief Futurist Brett Winton predicted that real GDP growth could reach 7% annually on average in the current business cycle, surpassing the rate seen in any year since 1950, thanks to the impact of transformative technologies.

In closing, Dalio’s analysis provides valuable insights into the current state of the U.S. stock market and offers a balanced perspective on the potential for a market bubble. As investors continue to navigate the volatility and uncertainty in the market, it is essential to consider various viewpoints and analyses to make informed decisions.